Search for a doctor or hospital in your network.

Search for a doctor or hospital in your network.

Get News & Updates Directly To Your Inbox

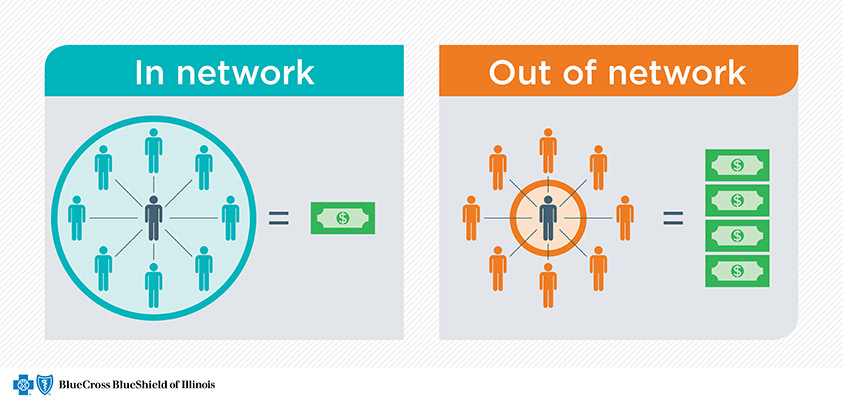

Premiums, copays and deductibles are all things you need to consider when choosing the best health plan for you or your family. Did you know you should also think about the plan’s provider network? Here's why:

While there are many types of health plans, the two most common are HMO and PPO.

Because this can be a big factor in your medical visits, here are some questions to consider as you choose your health plan:

Insider’s tip: Search online to see if doctors, hospitals and urgent care centers are in network for the plan you are considering. Once you're a member, you can get a more personalized search based on your coverage.

Ready to choose your plan? Make sure you’re ready for Open Enrollment.

Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation,

a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association

© Copyright 2026 Health Care Service Corporation. All Rights Reserved.

Verint is an operating division of Verint Americas, Inc., an independent company that provides and hosts an online community platform for blogging and access to social media for Blue Cross and Blue Shield of Illinois.

![]() File is in portable document format (PDF). To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at https://www.adobe.com/trust/accessibility.html.

File is in portable document format (PDF). To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at https://www.adobe.com/trust/accessibility.html. ![]()

![]() You are leaving this website/app ("site"). This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. Some sites may require you to agree to their terms of use and privacy policy.

You are leaving this website/app ("site"). This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. Some sites may require you to agree to their terms of use and privacy policy.

Powered by Verint