Search for a doctor or hospital in your network.

Search for a doctor or hospital in your network.

Download the BCBSIL App. Your coverage information in the palm of your hand.

Get News & Updates Directly To Your Inbox

An EOB is a notice you get when a health care benefits claim is processed by your health plan. The EOB shows the expenses submitted by the provider and how the claim was processed.

If you get paper EOBs, an EOB will be mailed to you after a claim has been finalized. If you are signed up for paperless statements, you'll get an email when your EOB is ready to view in your Blue Access for MembersSM (BAMSM) account.

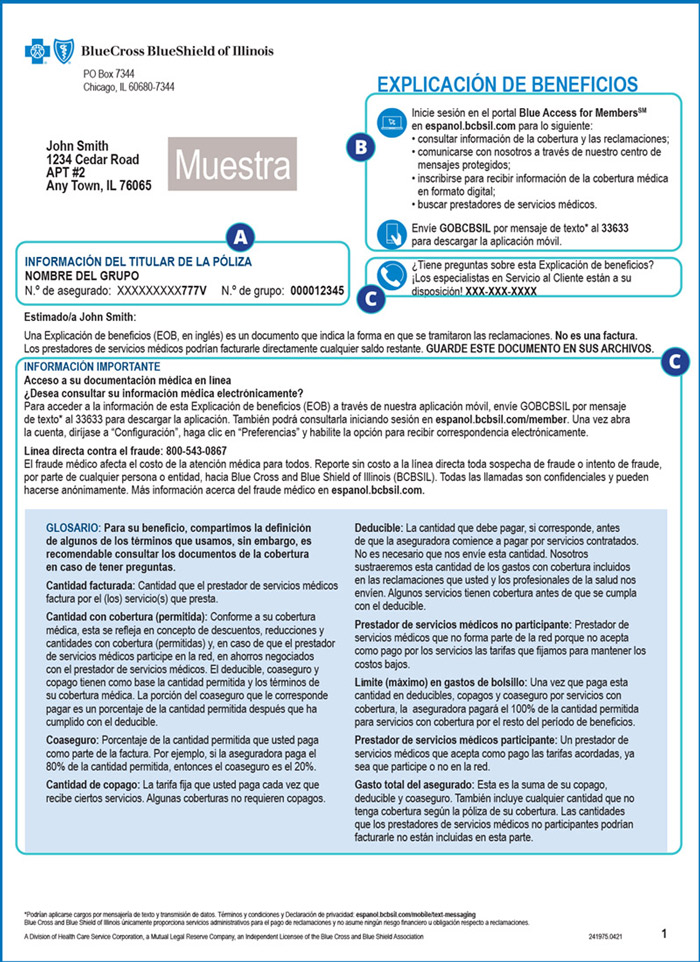

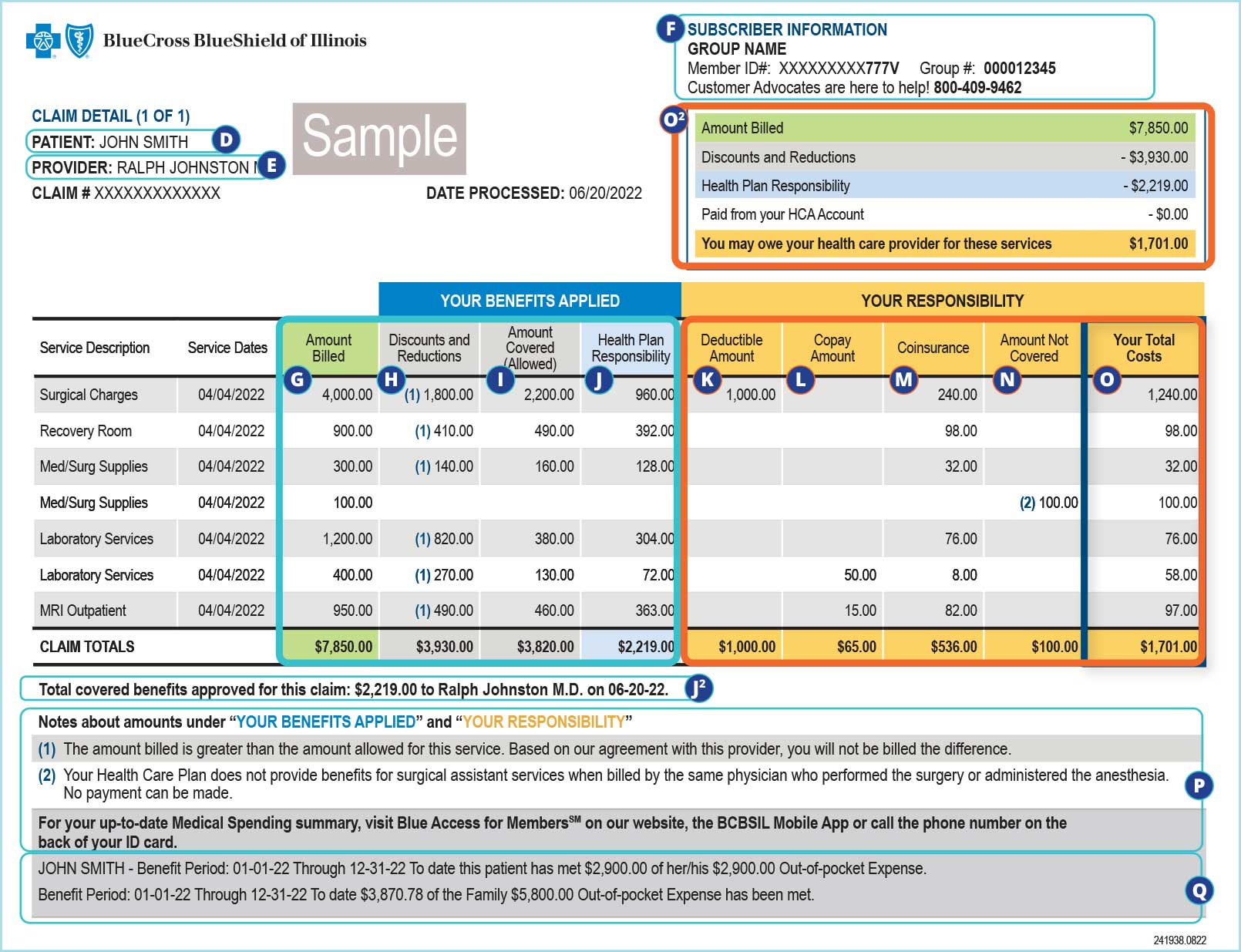

Below is a sample EOB that explains all of the sections. Keep in mind that every plan is different. The charges on your EOB are according to your plan's coverage and the services you received.

A. Your member ID and group numbers

B. How to access your claims online

C. Helpful contacts and glossary

Top:

D. Patient information

E. Provider information

F. Policy information

Details:

G. Amount billed by the provider

H. Discounts and reductions in compliance with your plan

I. Amount covered is the amount billed (G) minus the discounts and reductions (H)

J. Health plan responsibility is the portion your health plan pays to the provider

K. Deductible amount

L. Copay amount

M. Coinsurance amount

N. Amount not covered

O. The amount you’re responsible for. This column provides details about the amount you may owe shown in the claim summary (O2)

O2. Claim summary

J2. Total covered benefits approved is the amount that was paid to the provider

P. Numbered notes provide additional details

Q. Health care plan maximums

Your EOB is an important record of claims for services paid from your benefits. You need to carefully check your EOB. You want to be sure that the services you received match the services you were billed for. If something looks wrong, call us at the number on your member ID card. Or call your provider's office to ask about it.

Keep your EOBs in case questions come up later about your claim or your bill. If you’ve registered for BAM, we store your EOBs there for 18 months.

You can get more information in BAM. And check out these Health Care Coverage 1-on-1 videos to learn more about EOBs and other coverage information and insurance terms.

Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation,

a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association

© Copyright 2026 Health Care Service Corporation. All Rights Reserved.

Verint is an operating division of Verint Americas, Inc., an independent company that provides and hosts an online community platform for blogging and access to social media for Blue Cross and Blue Shield of Illinois.

![]() File is in portable document format (PDF). To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at https://www.adobe.com/trust/accessibility.html.

File is in portable document format (PDF). To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at https://www.adobe.com/trust/accessibility.html. ![]()

![]() You are leaving this website/app ("site"). This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. Some sites may require you to agree to their terms of use and privacy policy.

You are leaving this website/app ("site"). This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. Some sites may require you to agree to their terms of use and privacy policy.

Powered by Verint